In June 2015 In his keynote speech to the recent National Federation of Tenant Management Organisations (NFTMO) national conference, SHOUT’s Tim Morton warned of the dangers to social housing presented by the Government’s proposal to extend the Right to Buy to housing association tenants. The issue being the forced sale of “high value” council properties in order In response Leathermarket JMB, a TMO based in the London Borough of Soutwark tweeted: Right to buy for housing associations may mean that Leathermarket JMB may never let a council home ever again

They subsequently followed this up with: Lawyers tell #NFTMOconf15 ALL @lb_Southwark council homes class as high value for sell-off under Govt Hsg Asn #righttobuy plans

This is a pretty stark thought, that a community led housing organisation might never let another home to a person or family in housing need. This is bad enough, but this is also an existential risk to TMOs in high value areas – as stock is sold off, the viability of the TMO will reduce.

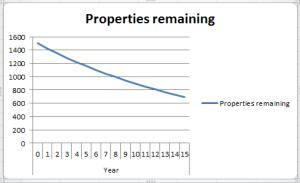

Leathermarket JMB manages about 1500 homes, if just 5% of those homes become vacant each year then they would see 75 properties sold off in the first year alone. After just 8 years, they would have lost more than a third of the stock they manage and after 14 years they would be down to just below half (732) – and that is not taking into account any Right to Buy sales.

Loss of stock on this scale would be devastating for a TMO as it would have serious implications for the level of allowances, and as such the viability of the organisation. It would inevitably mean job losses and a degradation of services to tenants. The TMO would lose economies of scale and have to provide services to fewer home but spread across the same geographic area with less money to do it. Overheads as a proportion of total income would increase.

It is not just the financial impact that is of concern, but the effect on the community as the tenure mix of the community would be radically changed in a short period. Most TMOs are quite used to managing mixed tenure communities and in the right balance this is a normal and healthy state of affairs. In flatted estates, the interests of tenants and owner occupying leaseholders are often closely aligned and many TMOs have leaseholders as members and active participants.

However we know that 40% of homes sold under Right to Buy are now owned by private landlords, there is clearly high demand for ex-council properties as rental investments. With the sale of empty homes at market value this pro[portion is likely to be far higher because you won’t have the contingent of former tenants who could only afford to buy because of the discount. In areas with lots of high value properties this will lead to a rapid change in the tenure mix in the community. A large increase in non-resident landlords and private tenants with no more security than 6-12 month assured short-hold tenancies is not going to do anything good for community stability and cohesion.

The impact of the 1% reduction in social rents

It is not just the prospect of the sale of empty homes that makes the Right to Transfer the obvious course of action for TMOs – the prospect of 4 years of 1% rent reductions should have them seriously considering it too. TMOs with few exceptions operate using allowances from their local authority landlord, these being a proportion of the rental income. Landlords hold the whip hand with regards to the level of allowances (my own TMO has had frozen allowances in recent years as the landlord increased rents) and tenants should be under no illusion as to what rent reductions will mean for their allowances.

1% may not sound much, but when compared with the anticipated CPI+1% increases, the real difference after 4 years is 8-12% in real terms – assuming inflation at 1-2%, if it gets higher than that then the damage is much worse. For long term business plans the situation is compounded as future rent increases are now based on a lower starting point, so the cumulative effect on income over 30 years is massive, one estimate I’ve seen is that it blows a 20% hole in the business plan. It is safe to say that faced with reductions on this scale, landlords will have no choice but to pass the reduction on to TMOs through reduced allowances. If I were a local authority facing cuts to my own services I may not be able to resist the temptation to make my managing agents take more than their fair share of the pain. Either way, TMOs will have to try to continue to deliver services to tenants with much less money than they had planned for.

A very toxic brew

For TMOs facing the combined threats of rapid loss of stock through forced sale of voids and significant real terms cuts in allowances the future looks bleak. For some it may mean that they cannot continue in management at all – it is a very serious existential threat.

The solution – use the Right to Transfer

This is where Right to Transfer comes in as a highly attractive alternative. It would avoid the prospect of the sale of empty homes to fund Right to Buy for housing association tenants, thus stemming the haemorrhage of stock needed to remain viable. It would also allow the TMO to plan a viable business case based on the whole rental income, rather than being dependent on a fraction of the rent paid in allowances. The rent reduction would still be painful, but with the whole rent to play with there would be far more scope to manage – tenants would not be propping up council services through their rent and they would be able to plan investment to make best use of resources to suit their local needs, not rely on a borough wide plan subject to the competing interests of the local authority and the agendas of local politicians.

I say use the Right to Transfer because it puts power in the hands of tenants, but I would expect enlightened local authorities facing similar challenges, to be keen to work with TMOs on community led transfer. Tenant ownership and the preservation of social housing has to be a better option than the prospect of stock loss and managing decline that may well be the alternative.